All Categories

Featured

Table of Contents

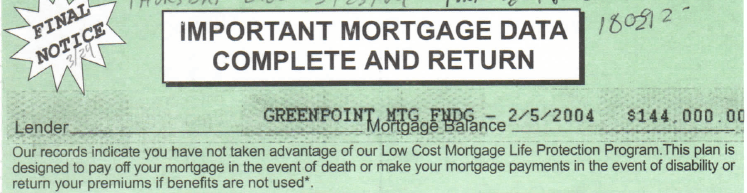

Home mortgage life insurance coverage provides near-universal coverage with marginal underwriting. There is frequently no medical exam or blood sample required and can be an important insurance coverage option for any type of home owner with serious pre-existing clinical conditions which, would certainly stop them from buying traditional life insurance policy. Various other advantages consist of: With a home loan life insurance coverage plan in position, beneficiaries will not have to fret or question what could happen to the family members home.

With the mortgage repaid, the household will always belong to live, offered they can pay for the building taxes and insurance yearly. insurance that pays house in case of death.

There are a few different sorts of home mortgage security insurance coverage, these consist of:: as you pay more off your home mortgage, the quantity that the plan covers lowers according to the impressive balance of your home mortgage. It is one of the most usual and the most affordable kind of home loan protection - mortgage protection insurance unemployment.: the quantity guaranteed and the premium you pay stays degree

This will certainly repay the home loan and any kind of remaining balance will most likely to your estate.: if you want to, you can include serious illness cover to your mortgage security policy. This indicates your mortgage will certainly be gotten rid of not only if you pass away, but likewise if you are detected with a serious illness that is covered by your policy.

Should I Buy Mortgage Protection Insurance

Additionally, if there is a balance staying after the home loan is cleared, this will go to your estate. If you change your home mortgage, there are numerous things to take into consideration, depending upon whether you are topping up or expanding your mortgage, changing, or paying the home loan off early. If you are topping up your home loan, you require to make certain that your policy meets the brand-new value of your home mortgage.

Compare the costs and advantages of both alternatives (home loan insurance or term insurance). It may be cheaper to maintain your initial home loan defense policy and then acquire a second policy for the top-up amount. Whether you are covering up your home mortgage or expanding the term and need to get a brand-new plan, you might find that your premium is more than the last time you got cover

Instant Mortgage Insurance Quotes

When changing your mortgage, you can designate your home loan protection to the brand-new lending institution. The costs and degree of cover will coincide as prior to if the quantity you obtain, and the regard to your home mortgage does not alter. If you have a plan through your lending institution's team system, your loan provider will certainly cancel the plan when you switch your home loan.

In California, mortgage security insurance coverage covers the entire impressive equilibrium of your funding. The death benefit is an amount equivalent to the equilibrium of your home loan at the time of your passing.

Mortgage Redemption Insurance Policy

It's important to recognize that the survivor benefit is provided straight to your financial institution, not your enjoyed ones. This assures that the remaining financial debt is paid completely and that your loved ones are spared the financial strain. Mortgage defense insurance can additionally provide temporary protection if you come to be impaired for an extensive period (generally 6 months to a year).

There are many benefits to getting a home loan protection insurance plan in California. Several of the top benefits consist of: Ensured approval: Even if you remain in bad health or operate in an unsafe profession, there is ensured approval without clinical exams or lab tests. The same isn't true for life insurance coverage.

Special needs defense: As specified over, some MPI plans make a few mortgage payments if you become impaired and can not generate the exact same earnings you were accustomed to. It is necessary to keep in mind that MPI, PMI, and MIP are all different kinds of insurance coverage. Mortgage security insurance coverage (MPI) is designed to repay a home loan in instance of your death.

Loan Insurance Premium

You can even use online in minutes and have your plan in position within the same day. For more information about obtaining MPI insurance coverage for your mortgage, call Pronto Insurance coverage today! Our experienced agents are below to answer any concerns you might have and give more help.

MPI uses numerous advantages, such as tranquility of mind and simplified credentials processes. The fatality benefit is straight paid to the lending institution, which restricts flexibility - mortgage protection coverage. In addition, the benefit amount decreases over time, and MPI can be more pricey than standard term life insurance coverage policies.

Nationwide Mortgage Protection

Enter basic info concerning on your own and your home mortgage, and we'll contrast rates from different insurance providers. We'll additionally reveal you how much insurance coverage you require to safeguard your home loan.

The major advantage right here is clearness and self-confidence in your decision, understanding you have a strategy that fits your demands. As soon as you accept the plan, we'll handle all the paperwork and arrangement, ensuring a smooth execution process. The positive outcome is the assurance that includes recognizing your family members is protected and your home is secure, regardless of what takes place.

Professional Guidance: Guidance from knowledgeable specialists in insurance policy and annuities. Hassle-Free Arrangement: We deal with all the documents and implementation. Economical Solutions: Finding the most effective protection at the most affordable possible cost.: MPI specifically covers your home mortgage, providing an extra layer of protection.: We work to locate one of the most cost-effective services customized to your budget.

They can give info on the coverage and benefits that you have. Usually, a healthy person can expect to pay around $50 to $100 per month for mortgage life insurance policy. Nonetheless, it's advised to obtain an individualized home mortgage life insurance coverage quote to obtain an exact quote based upon individual situations.

Latest Posts

Funeral Cover For Old Age

Aarp Burial Insurance

Life Insurance Cover Funeral Expenses